How GST Invoice Software Bridges Finance, Billing, and Compliance

For modern businesses, three elements define financial success — finance management, accurate invoicing, and compliance with regulators. However, they can be difficult to handle separately, especially when GST requirements add complexity. This is why businesses are quickly turning to GST invoice software, which acts as a bridge between these important functions.

Connecting Billing with Finance

Billing is the starting point for each transaction, but when handled manually, it often causes discrepancies in the accounting register. GST invoicing software simplifies this by generating invoices that are synchronized directly with financial systems. Each challan automatically updates sales, purchases, and tax data, giving companies a clear view of revenue flow. This integration ensures that financial reports always align with billing activities, saves time, and prevents errors.

Ensuring Compliance from the Start

One of the biggest benefits of GST invoice software is its built-in compliance framework. Each challan created is GST-ready, including fields such as GSTIN, HSN/SAC code, and tax distribution. This means businesses don’t have to manually verify invoices for compliance or worry about incorrect tax percentages or missing details. At the end of the month or quarter, the software generates GST-ready reports, reducing the stress of final calculations.

A Centralized Platform for Accuracy

Traditionally, companies relied on different systems — separate tools for invoicing, financial accounting, and manual compliance efforts. This disconnection often led to duplicate work and inconsistencies. GST invoice software centralizes these processes, ensuring that all details — from invoice creation to tax reporting — are accurate and consistent. By minimizing human errors, it strengthens transparency and trust in business operations.

Real-Time Insights for Decision Making

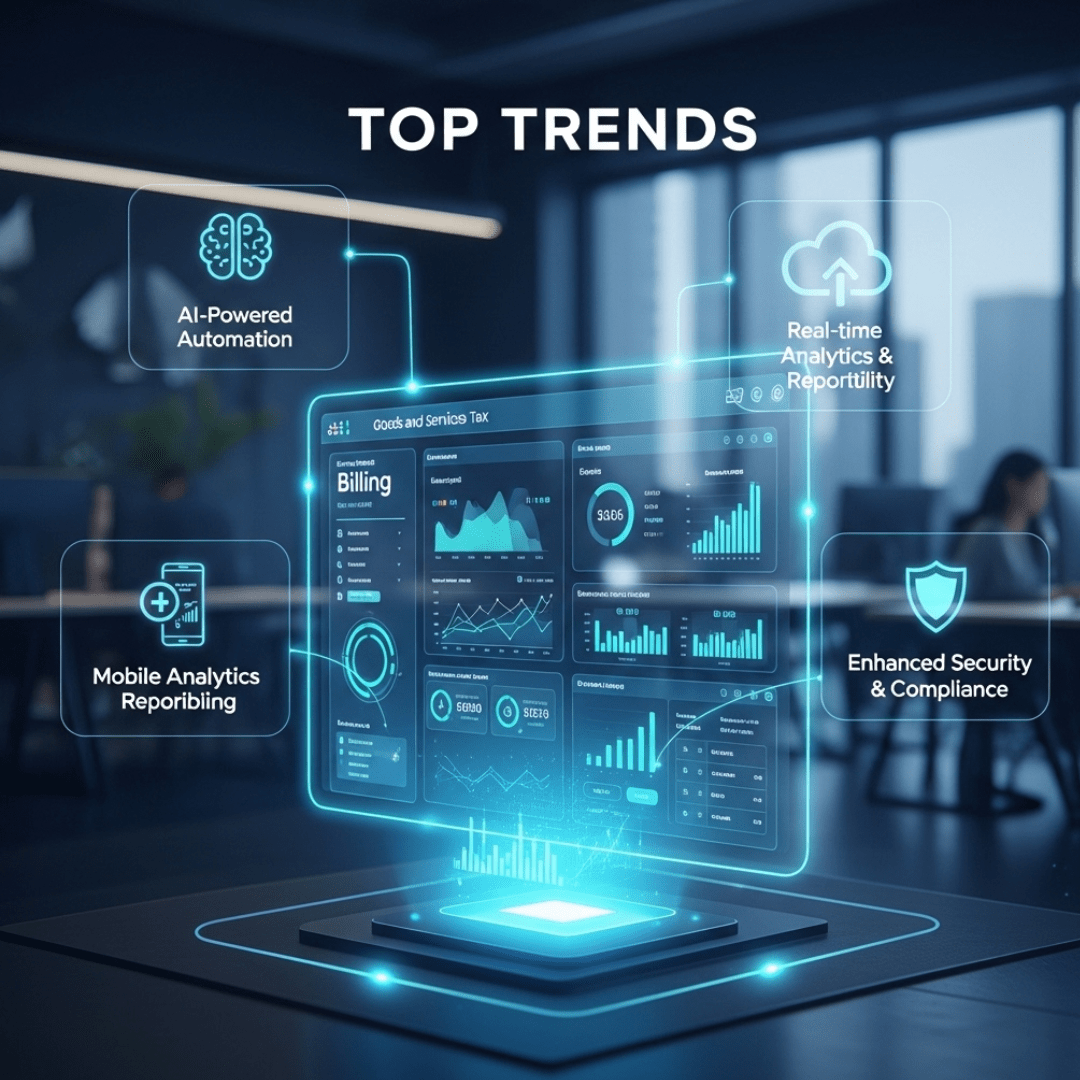

Another advantage of GST invoice software is advanced analytics. Since billing, financial, and compliance data are linked, business owners can track receivables, monitor tax obligations, and analyze profit margins instantly. Real-time dashboards and reports provide actionable insights, helping management make informed financial decisions while staying ahead of compliance requirements.

Building a Future-Ready Business

In today’s competitive environment, efficiency and compliance go hand in hand. A company that uses GST invoice software gains more than just an invoicing tool — it acquires a digital backbone that supports scalability. Whether handling a growing customer base, adapting to changes in GST rules, or planning future investments, this software ensures everything runs under one unified system.

Conclusion

GST invoice software brings together finance, billing, and compliance in one streamlined platform. It removes manual work, reduces compliance risks, and provides business owners with the confidence to grow. For any business looking to save time, minimize errors, and remain GST-compliant, adopting GST invoice software is a smart and future-ready decision.