How GST Billing Software Simplifies Inventory and Invoicing Together

Today, the administration of a business involves more than selling products or services. Two of the most important aspects are stock management and invoices. Both must be error-free, efficient, and state tax regulations-compliant. These processes have been more critical to companies in India, particularly with the introduction of Goods and Services Tax (GST). This is where GST-invoicing software comes in, and offers an integrated solution that simplifies inventory tracking and invoices under a system.

The Link Between Inventory and Invoicing

Traditionally, businesses handled storage management and invoices separately. Lagging tracking was often performed using a spreadsheet or manual registers, while individual invoices were prepared for each transaction. This dissatisfied process often gave rise to errors such as incorrect levels, incorrect prices, and delays in generating invoices.

However, fixtures and invoicing are closely associated. Each Challan generated directly affects the count of warehouses, and each stock movement should be reflected in the financial records. By combining both in a single GST invoicing software, business stability, accuracy, and compliance can be ensured.

Real-Time Inventory Updates

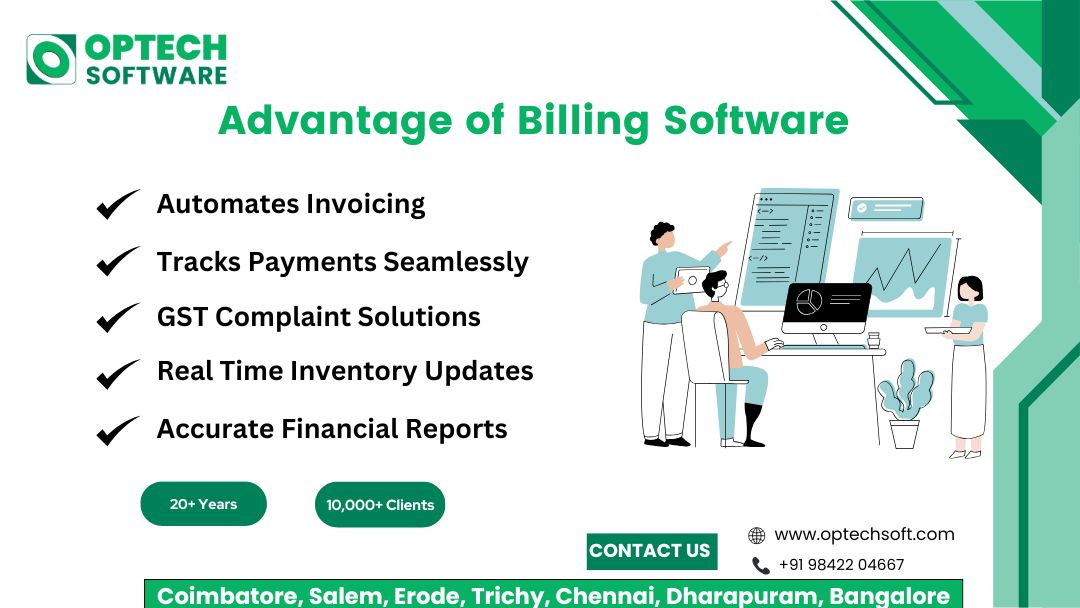

One of the main benefits of GST-invoicing software is Real-Time Inventory management. Each time a sale is made and an invoice occurs, the system automatically updates the stock level. Similarly, when the new stock is purchased and recorded in the system, it is immediately reflected in the storage posts.

This automatic process eliminates manual warehouse adjustment, reduces human errors, and ensures that the owners of the business always know their accurate share status. It helps to avoid stock, overstocking, and financial deviations.

GST-Compliant Invoicing Made Easy

Creating Invoices manually under GST rules can be challenging, as it requires the right tax rates, HSN/SAC code to search, and ensuring proper formatting. GST billing software automatically generates. With predefined rules and product details stored in the system, Challans are generated quickly and accurately.

In addition, the software ensures that the invoices are always in line with the latest GST rules. Companies can generate different types of GST invoices, such as tax challenges, credit notes, debit notes, and export expenses, without any problems. This not only saves time, but also helps companies avoid punishment due to non-transport.

Time and Cost Savings

Automation is not just about accuracy - it also saves time and reduces operating costs. Employees no longer need to enter data twice or manually cover the invoice with an invoice. This releases the resources that can be used for more productive functions, such as customer service and commercial development.

GST billing software lowers administration costs through minimizing paper work, shrinking mistakes and simplifying operation. It can enhance the profitability particularly of the small and medium sized businesses to a large extent.

Enhanced Customer Experience

A smooth invoice process contributes directly to customer satisfaction. With GST Billing software, invoices can be generated immediately and shared digitally via e-post or WhatsApp. Customers get clear, accurate bills, and companies get a more professional image.

In addition, corporate customers can track procurement history, provide loyalty discounts, and ensure timely communication on orders. It creates faith and strengthens long-term customer relationships.

Conclusion

The GST billing software performs just more than handling tax compliance - it integrates invoices and inventory into a single, effective system. By offering real-time stock updates, automatic GST-not-formal invoice, practical reporting, and improvement in better customer experiences, it makes the operation of the business significantly simplified.

For modern businesses, it is not just investing in GST-invoicing software to meet the requirements for compliance; It is about creating efficiency, saving costs, and preparing for permanent development.