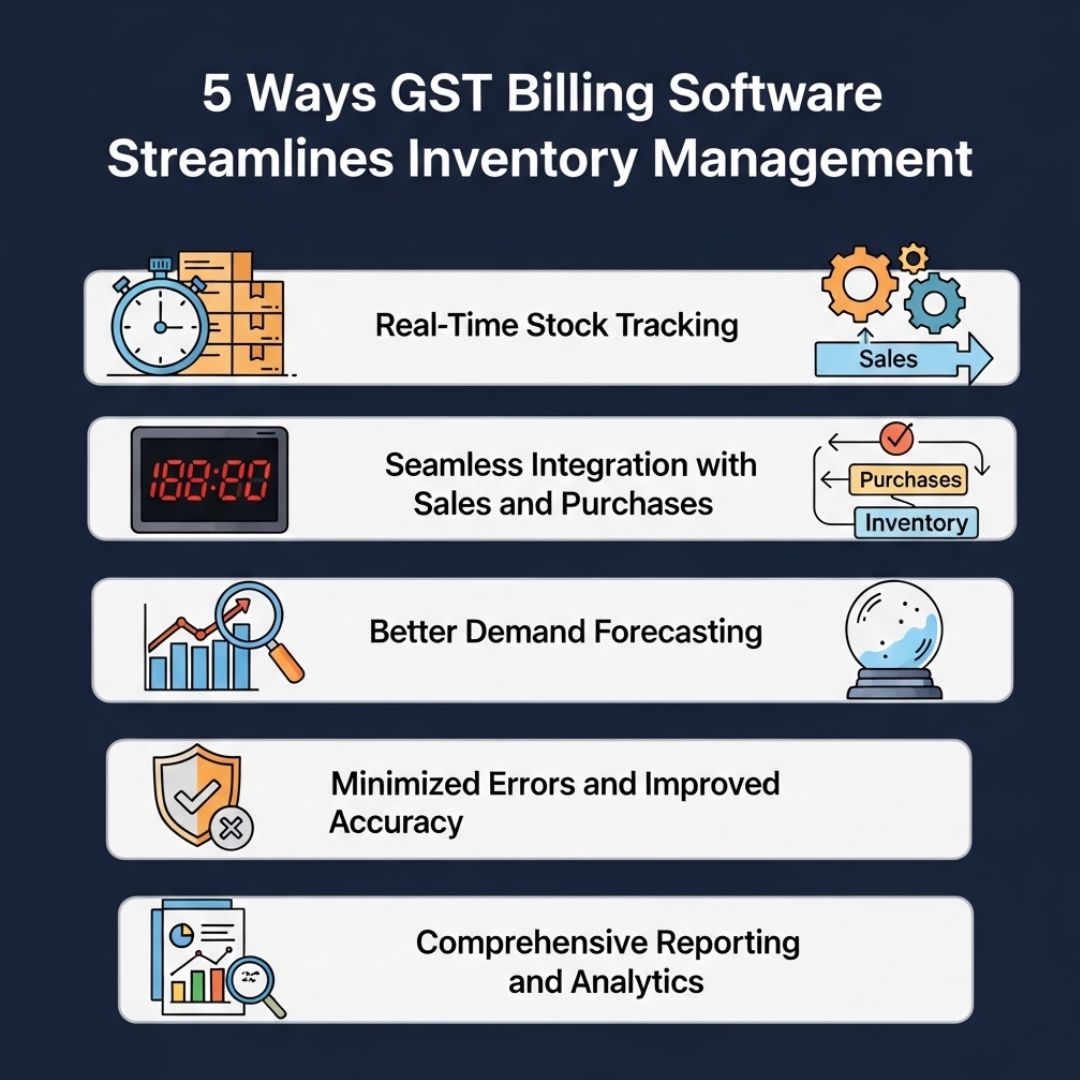

5 Ways GST Billing Software Streamlines Inventory Management

In today's fast-paced business environment, managing inventory effectively is a key challenge. For companies of all sizes, maintaining control over storage levels can be challenging, and managing sales data can be overwhelming without the right tools. This is where GST-billing software comes in — not only simplifying tax compliance, but also streamlining inventory management. By integrating challan with stock tracking, companies gain better visibility, accuracy, and control over operations. Let's look at five main ways GST-billing software improves inventory management.

1. Real-Time Stock Tracking

One of the biggest challenges for companies is managing the amount of stock they have at any given time. Manual methods often lead to errors, delays, or surpluses. With GST-billing software, stock updates occur automatically with each sale or purchase transaction. This ensures real-time tracking so you always know exact stock levels, prevents shortages, and helps you reorder at the right time.

2. Seamless Integration with Sales and Purchases

GST billing software integrates seamlessly with sales and purchase invoices. When you generate a GST invoice for a customer, the system automatically deducts the goods sold from your inventory. Similarly, when you register a purchase, the stock level is immediately updated. This integration reduces manual work, eliminates duplicate entries, and ensures both invoices and inventory remain perfectly aligned.

3. Better Demand Forecasting

Businesses need accurate forecasts to avoid overstocking or understocking. GST-billing software provides detailed reports on sales trends, fast-moving products, and seasonal demands. This insight helps companies make smarter purchasing decisions and prepare for peak demand periods. By analyzing historical sales and stock movements, businesses can optimize stock levels and cut unnecessary costs.

4. Minimized Errors and Improved Accuracy

Manual stock entry and paper-based records are prone to human error. Mistakes in product data not only disrupt inventory management but can also impact GST compliance. GST-billing software reduces these risks by automating updates and generating accurate records. This minimizes discrepancies in stock reports, ensures precise GST returns, and protects businesses from penalties or reconciliation issues.

5. Comprehensive Reporting and Analytics

Effective inventory management is not just about tracking stock — it’s also about using data to improve decision-making. GST-billing software provides advanced reporting features that give businesses valuable insights into product performance, stock aging, and supplier efficiency. With detailed reports at your fingertips, you can identify underperforming products, improve cash flow, and make data-driven inventory decisions that enhance profitability.

Conclusion

GST-billing software is no longer just a tool to generate tax-compliant invoices — it is a complete solution for managing inventory effectively. From real-time stock tracking to advanced reporting, it enables companies to maintain better control, reduce waste, and improve overall productivity. By adopting GST-billing software, businesses can ensure compliance, strengthen inventory management, and achieve sustainable growth.