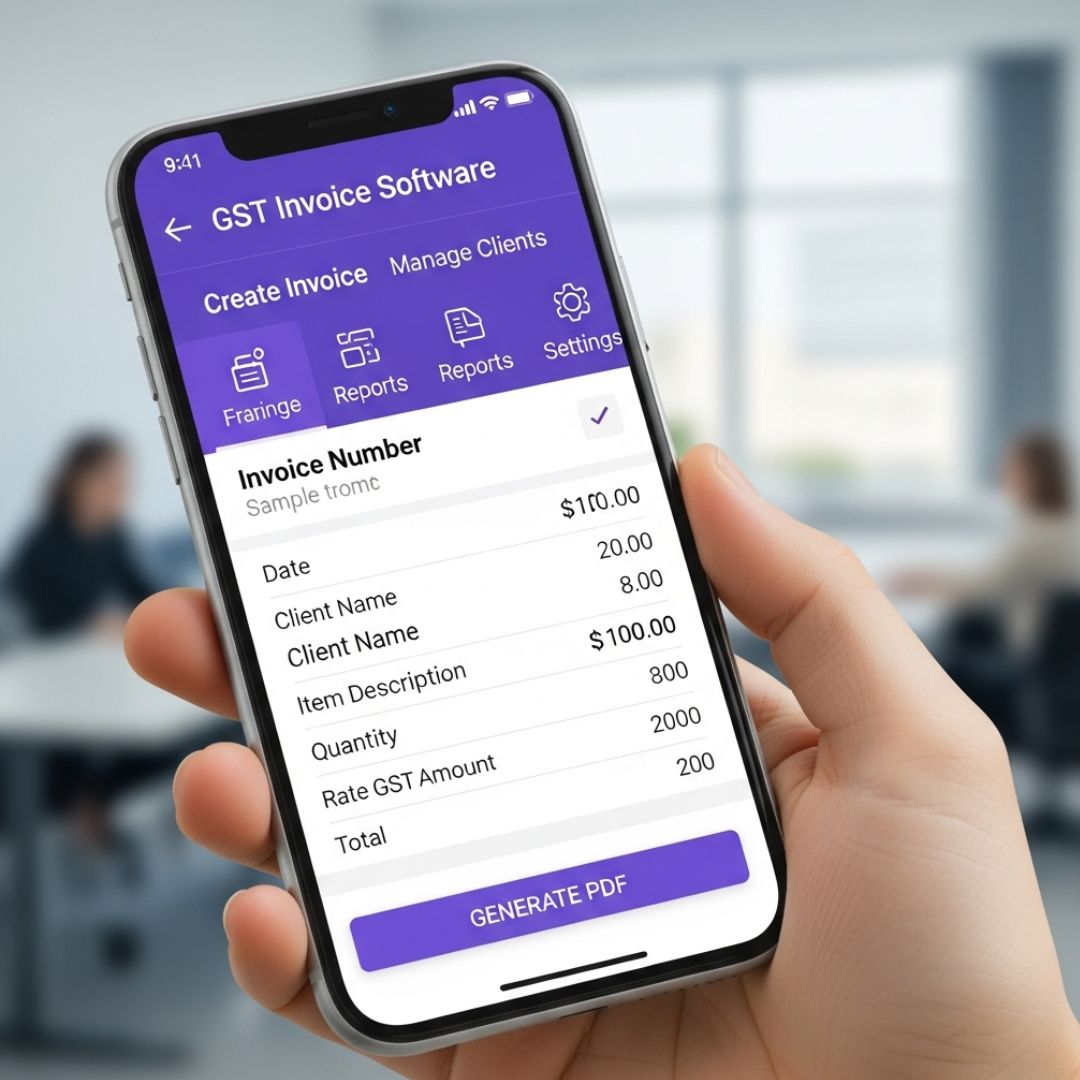

How GST Invoice Software Mobile App Integration Supports SMEs

The Small and medium-sized enterprises (SMEs) in the modern competitive business world require intelligent tools that simplify their business processes while ensuring compliance with state regulations. One of the biggest challenges is that SME faces GST invoicing and challenge effectively. With the integration of mobile apps into the GST invoice software, companies now have the flexibility and control that they need at their fingertips.

Real-Time Invoicing on the Go

Mobile app integration enables small and medium-sized enterprises to send, track, and manage invoices without relying on desktop computers or lengthy paperwork. The GST challan can be generated by the business owner or field personnel anywhere, ensuring it is fast and that customers are also satisfied. This also reduces the delay in payment, as a Challan can be sent immediately after the sale or service.

Simplified GST Compliance

GST requirements enforce the proper issuance of invoices, accurate record-keeping, and timely filing. It is overwhelming for small and medium-sized companies with a small number of employees. A mobile application for purchasing GST invoice software ensures that all invoice compliance is standardized, automatically calculates GST, and stores documents in a digital format. It minimizes human error and maximizes the likelihood of avoiding punishment when auditing or submitting.

Seamless Data Synchronization

Real-time data synchronization is one of the most important benefits of mobile app integration. All the records are automatically updated in the central system, whether the invoice is made by computer in the office or by a mobile phone in the field. This provides transparency, avoids duplication, and puts the finance team on the right track with the correct data.

Cost-Effective and Time-Saving

In the case of SMEs, resource management is essential. GST invoice solutions, which are mobile-enabled, limit the manpower that is required to process paperwork. Ready to file GST reports, which are automated, saving time and money, as well as instant generation of invoices. It will enable SMEs to concentrate more on development instead of engaging in manual repetitive assignments.

Enhanced Business Insights

Most mobile GST billing apps come with dashboards and analytics features. SMEs are able to keep track of sales patterns, outstanding invoices, taxes, and customer payment patterns as they are due. With this understanding, it is easy to make better decisions, ensure cash flow is managed efficiently, and it is also useful in planning business expansion.

Conclusion

Mobile app has stopped being an added service to GST invoice software, but rather a requirement for SMEs. It provides businesses with the capability to remain competitive in the digital economy by providing convenience, accuracy, and compliance support. Mobile-integrated GST invoicing is a clever move towards sustainable growth by SMEs that seek to automate their billing and enhance financial management.