ITR and Tax Audit Due Date Extended for FY 2024–25: Important Update for Businesses

The Income Tax Department officially announced the extension of the due dates of submitting Income Tax Return (ITR) and tax audit report till the Financial Year (FY) 202425. This declaration is a great relief to business, professionals and accountants in India who were finding it hard to meet the previous deadlines because of their work overload on compliance and technical side of the e-filing portal.

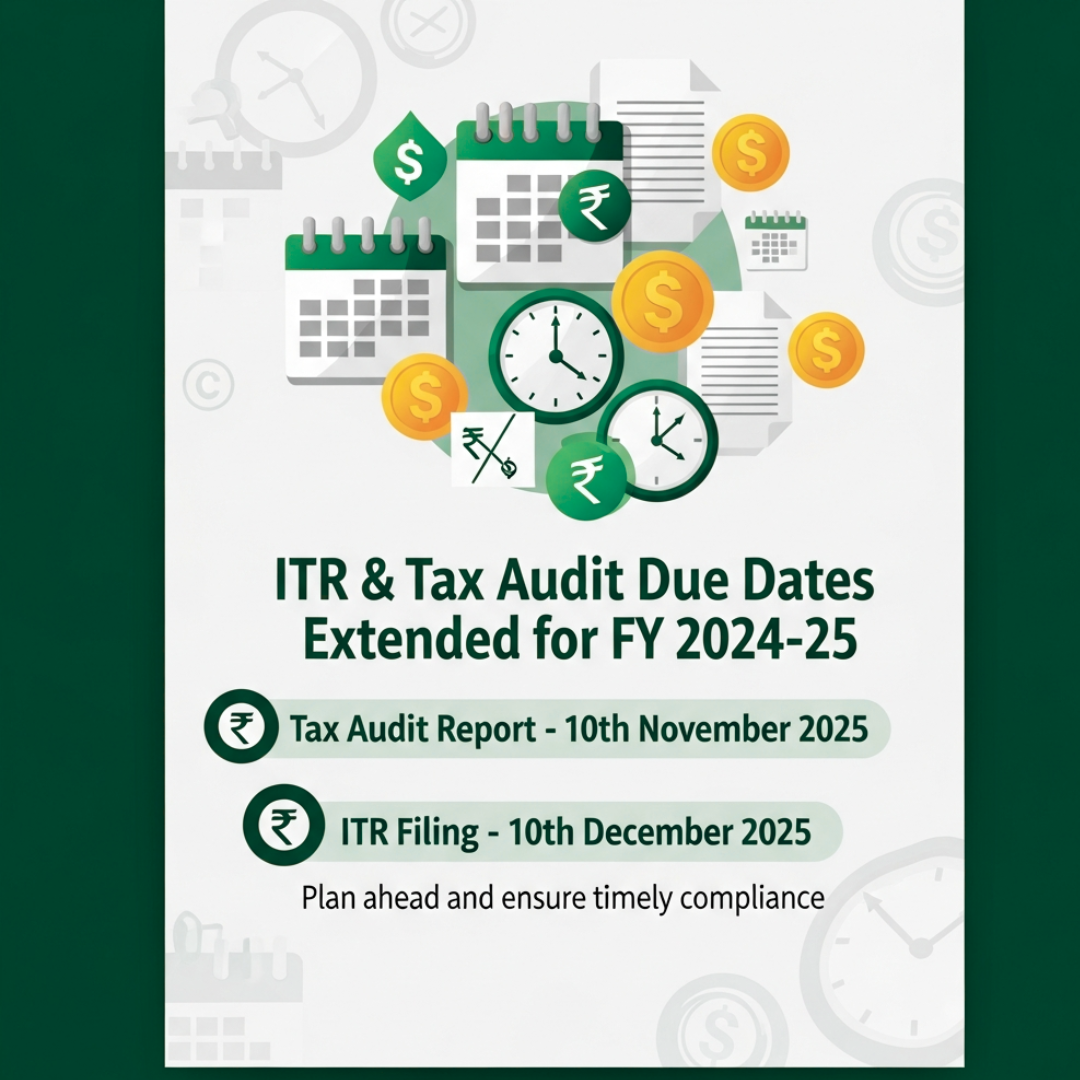

Revised Due Dates for FY 2024–25

According to the recent announcement, the final date of submitting the Tax Audit Report has been postponed to 10th November 2025. In line with this, the due date within which tax audit assessees are required to file their ITR has been extended to 10 th December 2025.

This relief will grant taxpayers with outstanding audit under Section 44AB of the Income Tax Act much-needed breathing space. It also provides Chartered Accountants with increased time to carry out their verification procedures, reconciliation of financial statements and proper reporting.

Who Should Pay Attention to This Extension?

The extended deadlines mainly apply to businesses, firms, and professionals who are required to get their accounts audited under the Income Tax Act. This includes:

- Companies whose annual turnover is more than 1 crore (and 10 crore in some cases of digital transactions).

- Individuals who have gross receipts of more than 50 lakh.

- The organizations that must report both international or stipulated domestic transactions.

Those taxpayers who are not under the audit conditions still should meet the standard deadline of ITR filing, and it usually is 31st July 2025 to FY 2024–25

Why the Extension Matters

The extension of due dates not only saves taxpayers from penalties but also ensures that they file their taxes accurately and in accordance with tax regulations. Here are some of the key benefits of this extension:

- Reduced Pressure on Businesses: The extended timeframe allows businesses to finalize their financial statements and audit reports without compromising on accuracy or quality.

- Better Compliance: Taxpayers get additional time to review details such as TDS credits, GST balances, and advance tax payments, ensuring accurate and complete ITR submissions.

- Avoiding Technical Errors: The income tax e-filing portal often experiences heavy traffic near the deadline. Extended dates help minimize server overloads and filing errors.

Key Compliance Tips Before Filing ITR

To make the most of the extension period, taxpayers should use this time effectively. Here are some essential compliance tips to ensure accurate and timely filing:

- Reconcile Books of Accounts: Ensure that your books match with GST returns, TDS statements, and bank records.

- Verify Form 26AS and AIS: Cross-check income details and TDS credits reflected in these forms with your records.

- Compute Depreciation Correctly: Follow the latest depreciation rules under the Income Tax Act to avoid discrepancies.

- Review Deductions and Exemptions: Claim all eligible deductions under sections like 80C, 80D, and 80G for tax savings.

- Consult a Professional: If your business involves complex transactions, seek assistance from a tax consultant or auditor.

Conclusion

The extension of the ITR and Tax Audit due dates for FY 2024–25 offers taxpayers much-needed relief and flexibility. However, it should not be viewed as an opportunity to delay compliance activities. Instead, businesses should utilize this extra time to ensure accuracy, avoid last-minute rushes, and maintain transparency in their financial reporting.

Filing your ITR and audit reports correctly and on time reflects sound financial discipline. It helps you stay on the right side of tax laws while contributing to a more compliant and transparent business ecosystem in India.